The holidays are around the corner and while you might not be thinking of moving yet, you should reconsider waiting until the Spring season to purchase your next home. Mortgage rates are working in your favor now to give you more buying power than ever before.

Freddie Mac explains:

“If you’re in the market to buy a home, today’s average mortgage rates are something to celebrate compared to almost any year since 1971…

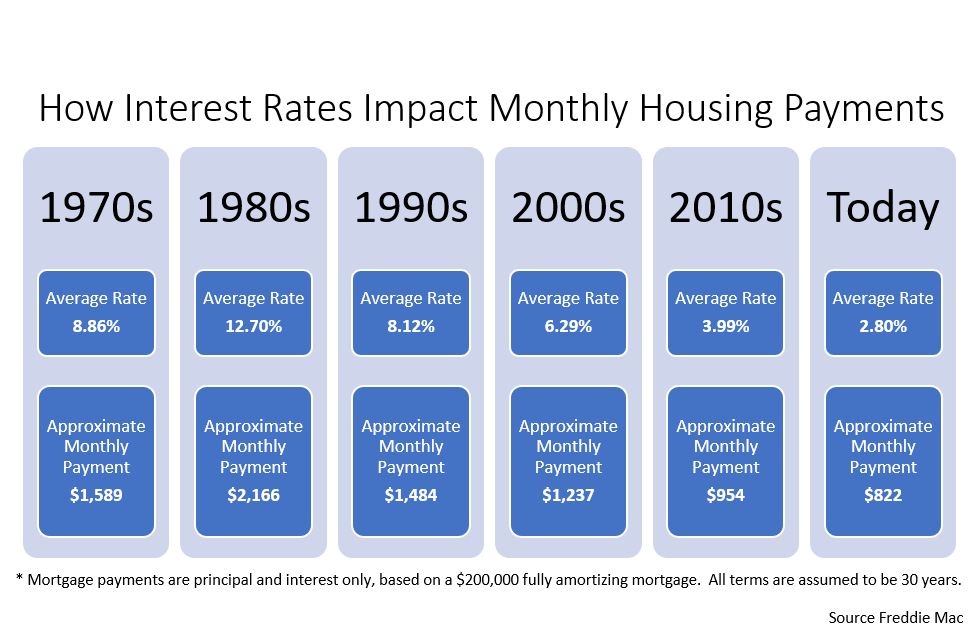

The following chart illustrates how average mortgage rates by decade have impacted the approximate monthly payment of a $200,000 home over time to give you some perspective.

Clearly, when rates are low – like they are today – qualified buyers can benefit significantly over time. Over the life of the loan in this example a homeowner will save approximately $47,520 over the term of the loan as compared to rates in the 2010s!

Bottom Line

While we don’t have a crystal ball to predict future interest rate fluctuations, waiting may mean a significant change in your potential mortgage payment should rates start to rise. If your financial situation allows, now may be a great time to lock in at a low mortgage rate to benefit greatly over the lifetime of your loan or potentially afford a better house than what you could when rates were higher.